10 Budget Highlights

Fairness is the right theme. Does Budget 2024 deliver enough of it?

Budget 2024 rightly returns us to a focus on fairness, with a special emphasis on a younger generation that has been squeezed. It also manages to strike both a progressive and prudent tone.

On the one hand, it shows ambition on housing, offers supply-side growth policies, and modestly expands social programs like the Canada Disability Benefit and pharmacare.

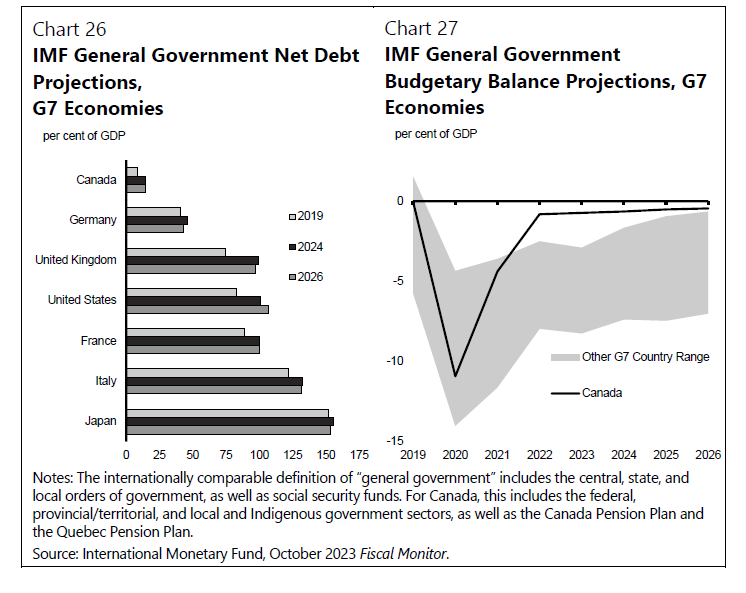

On the other hand, faced with inflationary headwinds and a resolute Bank of Canada, the budget walks a safe path of declining debt-to-GDP. And we continue to have the strongest balance sheet in the G7.

Coming in at over 400 pages with $480 billion in spending, it’s impossible to cover all ground. And there is a lot of ground, with a wide range of funding to boost legal aid and hire judges, improve rail service, combat hate, support the arts, crack down on auto theft, phase out animal testing, and much much more.

But here are 10 major highlights:

1. Housing, housing, housing.

The core focus of the budget is to get housing built. Most of the housing measures were announced pre-budget, culminating in the new housing plan published last week.

The updated plan is comprehensive, especially on the supply side. There’s new funding to spur rental construction, protect and build affordable housing, support the skilled trades, and expand the role of co-ops. The budget goes into greater detail on the huge push to make under-utilized federal lands (Canada Post, Defence, etc.) available for housing.

Importantly, we’re also pushing other levels of government to show ambition, offering provinces and municipalities new funding for infrastructure and transit if they add density, remove barriers, and welcome construction

Lastly, there’s a renewed financial commitment to end homelessness, with continued support to help municipalities house asylum seekers, $1 billion in new funding (over 4 years) for Canada’s homelessness strategy, and $250 million (over 2 years) to address encampments. We need to ensure a Housing First approach here and follow the lessons from Finland on prevention.

I have a longer post coming shortly on the housing plan. Most of the new spending comes in the form of low-cost loans and the approach to tackling the financialization of housing is flimsy, but this remains a serious federal housing plan overall that should force the Conservatives to rethink their own weak-kneed approach of slogans without substance approach if they want to win.

2. Fairness for our kids: a (healthy) school food program.

Too many families are struggling with affordability challenges and the national school food program is expected to help 400,000 more kids access healthy food and save the average family (with two kids) as much as $800 / year in groceries.

If the program is going to truly set our kids up for success, the food will also need to be healthy (the budget omits this). Agreements to flow the dollars should set conditions, including consistency with the science-based food guide.

On the subject of fairness for our kids, the budget highlights the major decline in child poverty rates, from 16.3% in 2015 to 6.4% in 2021, representing 650,000 children lifted out of poverty. This is mostly a consequence of our Canada Child Benefit and when people ask what the Liberals have accomplished, this is one very good answer.

Of course, we’ve also slashed childcare fees over the last few years, and the budget looks to build on that progress with $1 billion in low-cost loans to build more spaces and additional funding to support early childhood educators.

Still, it’s hard to see how the child poverty rate will decline much further without more substantive policy measures. UNICEF, for example, had called for a low-income top-up to the Canada Child Benefit. No question, there’s more to do on this front.

3. Supporting our science.

Most of the media coverage tends to seize on the $2.4 billion boost (over 5 years) to help Canada stay competitive in the global AI race, with a focus on compute power.

For my part, I was most interested to see the government increase core research grant funding with $1.8 billion (over 5 years, too back-loaded) in new tri-council support and $825 million (over 5 years, fairly spread) to increase the value of master’s and doctoral scholarship and post-doctoral fellowships.

It is the largest investment in 20+ years for grad students and postdocs.

Staying on the subject of post-secondary education, the budget points to changes to make loans interest-free and to increases in grants, noting that Canada Student Grants have doubled in size since 2014.

4. The long-promised Canada Disability Benefit.

As the past co-chair of the all-party anti-poverty caucus, I’ve prioritized the Canada Disability Benefit in my advocacy in many different ways, including in both my 2023 and 2024 budget submissions.

The guaranteed income supplement has served as a pillar of social support for low-income seniors, and a similarly fashioned CDB would improve the lives of people with disabilities with no or low incomes, address affordability in a serious way, and re-emphasize our commitment to fairness alongside the Canada Child Benefit, Canada Workers Benefit, and more.

Advocates had called for a big spend, upwards of $10 billion per year. Instead, the budget allocated $6.1 billion to the CDB over 6 years, and $1.4 billion / year ongoing. It amounts to a maximum top-up of $2,400 per year before income-based clawbacks.

On the one hand, this obviously falls short of a transformational policy. Disability Without Poverty called it “too little for too few.” I share that concern and would add that the delivery through the Disability Tax Credit also leaves a lot to be desired.

On the other hand, the CDB is one of the biggest new individual spending lines in the entire budget. Grappling with weak growth, high interest rates, and challenges to fiscal sustainability, the government still found a way to fund a significant first step. My colleagues and I will need to redouble our efforts to ensure funding improves in keeping with our economic situation.

5. Reinforcing our defence and humanitarian assistance.

Poilievre likes to pit these two ideas against one another, suggesting that defence policy is at odds with international humanitarian assistance. It couldn’t be further from the truth. As the Globe has previously noted: “Increased military spending is important in a world of greater geopolitical uncertainty, but the soft power that comes from a generous and wisely invested foreign aid program is a key complement to the ability to deploy Canadian forces.”

The budget rightly builds on both. It won’t meet the demands of advocates in these spaces, but in both cases there has been steady progress since 2015.

I can’t usefully speak to specific military needs, but additional (mostly back-loaded) investments will bring our defence spending to GDP ratio to 1.76% by the end of the decade. Yes, still short of the NATO target of 2%, but a significant increase from where the Conservatives left us under Harper.

Similarly, we have increased spending on development assistance in the face of conservative calls for cuts, even as we remain far off from the target of 0.7% of GDP. This budget adds support for Ukraine reconstruction and $350 million over 2 years in increased support for international humanitarian assistance. More development assistance is sorely needed. If there’s a theme here, it’s that there’s more to do.

6. Advancing reconciliation.

While it didn’t figure in the pre-budget slate of announcements, the budget builds on major funding progress since 2015 with an additional $9 billion over the next five years for Indigenous priorities.

The big items include work to improve access to education for First Nations students, support community-led solutions to reduce the number of Indigenous kids in foster care, expand health services, improve income assistance, strengthen economic opportunities (especially through the Indigenous Loan Guarantee Program), and close infrastructure gaps with funding for housing, schools and health facilities

And because it’s often the most asked question, it’s worth mentioning here that 144 long-term drinking water advisories have been lifted since 2015 (there were 105 in place when we were first elected). A further 271 short-term drinking water advisories have been addressed before becoming long-term advisories.

According to the budget, 94% of First Nations communities now have clean water. Meaningful progress with funding already in place to fix the remainder.

7. Stronger universal health care.

The feds have recently concluded major new bilateral health agreements with provinces and territories, with an important focus on increasing access to primary care and growing the healthcare workforce.

The budget builds on these efforts, with a focus on streamlining foreign credential recognition. It is absurd that less than 60% of the 200,000 internationally educated health professionals employed in Canada are employed in their chosen field.

On the heels of a new national dental care plan that represents a very sizable spend, the budget leans into the first phase of national universal pharmacare at a more modest $1.5 billion (over 5 years). To start, it will cover contraceptives and diabetes medication/treatments.

Lastly, recognizing the importance of mental health, the budget commits $500 million (over 5 years) to a new Youth Mental Health Fund. There’s also $150 million (over 3 years) committed to emergency responses to the opioid crisis, which is critical.

8. Climate action and environmental protection.

This isn’t a climate budget. Previous budgets have done most of the hard work on that front, and implementation of past promises is now the overriding focus.

The biggest climate line items in this one include a renewed subsidy for zero-emission vehicles and a reset of the the Canada Greener Homes grants for energy efficiency retrofits, this time focused on households with low to median incomes.

There are other worthwhile commitments, albeit with more modest price tags.

For example, as part of renewed funding for the Youth Employment and Skills Strategy, the budget commits to the development of a Youth Climate Corps program.

The budget also funds Parks Canada to deliver on our promise of new national parks and marine protected areas. It promises a new Impact Assessment, support for nuclear science research, and additional help for the EV supply chain.

$2.5 billion in fuel charge proceeds will also be returned to 600,000 businesses through a new tax credit that will hopefully help in the political fight to save pollution pricing.

There was a missed opportunity to apply an excess profits tax on oil and gas. The government should wear that. It should also stop boasting about a pipeline purchase that will never recoup its acquisition and construction costs.

9. Tax fairness: a buck is a buck.

How will the government pay for all of this new spending? In large measure, through an increase to the inclusion rate (not the tax rate!) from 50% to 66.67% on capital gains realized annually above $250,000 by individuals and on all capital gains realized by corporations / trusts.

There are a series of adjustments and caveats, including an increase in the lifetime capital gains exemptions (to $1.25 million) on the sale of farms and small businesses, maintaining the principle residence exemption (if you bought a house 20 years ago, your effective lottery winnings remain untaxed), and the inclusion rate will be reduced to 33.3% on a lifetime maximum of $2 million for entrepreneurs selling a business.

The change will raise $17.7 billion (over 5 years), it will impact 0.13% of people in a given year (outside of corporations), and it ensures that a buck is a buck.

Recall that famous investor and billionaire Warren Buffett and his secretary Debbie Bosanek have done interviews together, in which they pointed out that he pays a lower effective tax rate than she does and argued for greater tax fairness.

Here’s a chart in the budget that highlights a similar challenge:

Some economists have argued that the tax change will hurt productivity. Others disagree, noting that adjusting the capital gains inclusion rate to better align with wages and dividends isn’t a problem. It ensures, instead, that a buck is a buck.

It’s also worth noting that if one cares to address acute and problematic wealth inequality in Canada, personal capital income taxes are part of the answer. As my previous wealth tax motion argued: “the government should address rising extreme wealth inequality and generational concerns by implementing … c) changes in the tax treatment of investment income to ensure it is treated more equitably in relation to employment income earned by working Canadians.”

But don’t take it from me. Take this report from the OECD, for example, making the case that the tax system should address wealth inequality and that personal capital income taxes accompanied by inheritance taxation are more efficient together in meeting that goal than an ongoing net wealth tax (you can also listen to my podcast conversation with the author here).

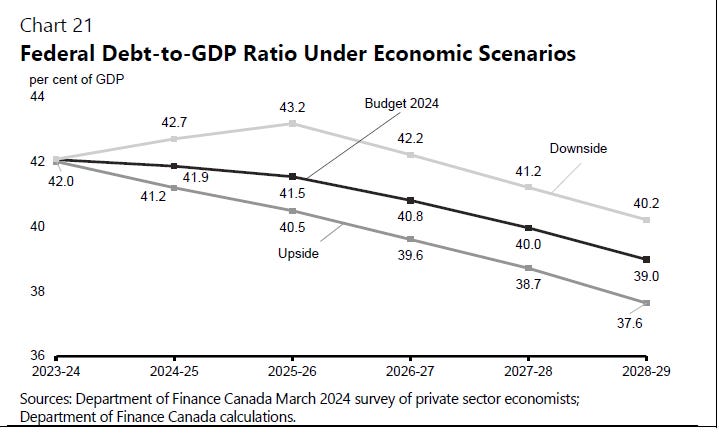

10. Fiscal prudence: declining debt-to-GDP

One could be forgiven for thinking this is an out-of-control budget based both on partisan sniping and uninformed commentary from people who should know better.

On cue, Poilievre was over the top, likening the Prime Minister to “a pyromaniac spraying gas on the inflationary fire” and he otherwise reverted to robotic phrases about common sense and carbon taxes.

More surprising, former Bank of Canada Governor David Dodge suggested the budget would likely be the worst since 1982. I wasn’t born in 1982, but I’m old enough to know that one should read a document before commenting on it.

The budget isn’t free from criticism, of course. There isn’t a balanced budget here. Deficits today (absent a productive return) mean less fiscal room to address tomorrow’s crises. And the budget is broadly focused on a number of measures, not squarely focused on productivity.

Despite these criticisms, the budget capably balances new spending alongside the fiscal prudence required to ensure interest rates will come down. The debt-to-GDP ratio is lower in 2024-25, and set to stay on a declining track.

And, again, Canada’s balance sheet remains the best in the G7.

While conservatives love to boast about their fiscal responsibility, we’ve certainly taken a more fiscally prudent approach than what we see here in Ontario. If Justin Trudeau is a pyromaniac, I’d love to know what Poilievre thinks of Doug Ford.

For an overall reality check, here’s economist Armine Yalnizyan: “$50 billion in new measures *over 5 years* in an economy of ~$3TR *a year* — and a growing output gap because of the Bank of Canada’s inflation fighting rate hikes — cannot trigger more inflation, mathematically speaking.”

For a fair but more critical review, see Kevin Page and the Institute of Fiscal Studies and Democracy react here: “Is this a good time for a classic tax-and-spend budget? There are legitimate yes and no arguments from a macroeconomic perspective.” Page and co. aren’t opposed to new spending, but politely reiterate the need for a value-for-money spending review alongside a greater focus on growing the economy.

In the end, the budget is solid and comprehensive, albeit not transformative. It finally shows real leadership on housing. It covers a lot of ground, with incremental progress in many important areas. And after the shock of a pandemic, it manages to meet political demands while maintaining fiscal prudence.

Thanks for presenting your summary of the key elements of the budget. The budget is always a huge document with a wide number of issues and initiatives. Even so, there are always issues or challenges missing. A major problem is that media and pundits tend to focus on one or two issues and then try to use these as a yardstick for measuring success. Then they throw on top of that paltry analysis their take on how it affects the horse race amongst the major parties.

As well, many interest groups assess the document from how it treats their one or two key issues. For example, it might be understandable that disability activists assign the budget an F or D grade. The overall grade though might be different if they were asked to grade the many sub-components. And then, if we are being honest I suspect it would be impossible to ever present a budget capable of achieving an A grade simply as any government has to face the conditions of the day and does not have an endless reserve with which to work.

"Agreements to flow the dollars should set conditions, including consistency with the science-based food guide"? Really?

Please show me the studies that show the Canada Food Guide is science based.

Since 1980 Canada has followed the American Dietary Guidelines. Since 1980 obesity and diabetes has increased exponentially.

Please read The Big Fat Surprise by Nina Teicholtz