Axing serious climate action with lies.

Just because it rhymes doesn't mean it's right.

Do you want to save the planet?

Good. Me too.

To do that, polluters should pay. It’s only common sense.

Cartoon by Theo Moudakis of the Toronto Star

Otherwise, polluting is costless for individuals while we all bear significant collective costs. The costs of wildfires and other disasters, the costs of smog, the costs to our kids of a less livable world.

The answer is simple: a price signal to make polluters change their behaviour and pollute less. We might even call it a price on pollution.

Since the goal is to change behaviour, not to make anyone worse off, we can recycle the revenue directly to households to make them whole. Let’s call it a carbon rebate.

This is smart policy, even if it might be difficult politics.

Leaders embrace these challenges, defend smart policy, and educate people to bring them along. In contrast, current conservatives rhyme cheap slogans - “axe the tax” and “spike the hike” - to dumb down our discourse and dismantle smart policy.

According to William Nordhaus, one of the 2018 Nobel Prize winner in economics, Canada is showing the world how carbon pricing can best work. Or, there are talk radio hosts who repeatedly call the price a penalty on ordinary Canadians.

Who are you going to believe?

Debating the price on pollution on Newstalk1010 with Jerry Agar

For those who want a deeper dive, here’s a rundown on how the price on pollution works efficiently, how the rebate gives most Canadians more cash than they pay, and why “technology not taxes” is an alliterative joke on our collective future.

Pricing pollution works.

Yes, price signals work. Even better, they work cost-effectively by harnessing the power of the market.

As the price of polluting increases, the market seeks out cleaner alternatives and businesses innovate to meet that demand.

Carbon pricing has been in place in BC since 2008. It’s used in dozens of jurisdictions around the world. And it’s a significant part of our climate action plan.

Here’s some quick back of the napkin math:

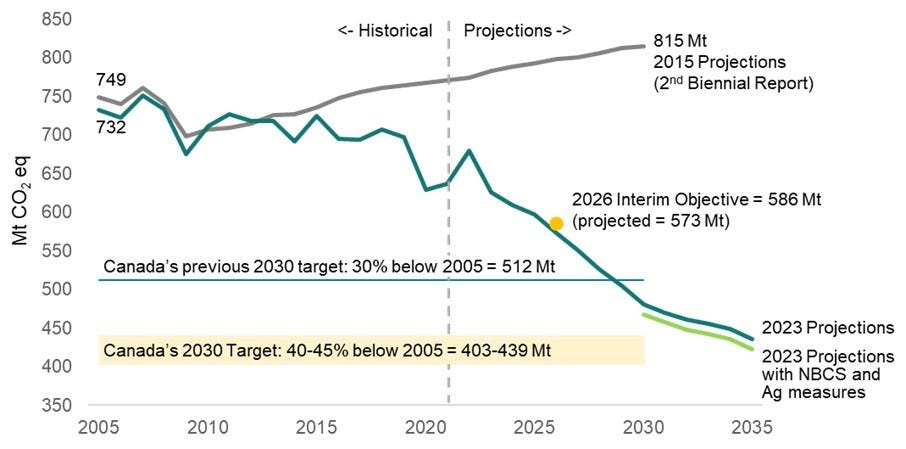

In 2015, Environment Canada projected 2030 emissions at 815 Mt under business as usual (i.e. conservative inaction). A recent independent analysis of that “no climate policy” scenario puts the number at 775 Mt.

With a suite of serious policies in place, in progress, and announced since that time, projected 2030 emissions now stand at 467 Mt, assuming stringent implementation of all policies announced/in development.

On Environment Canada’s assessment, carbon pricing overall (industrial + consumer) accounts for 79 Mt reductions by 2030. Or almost a quarter of the overall drop from business as usual in 2015.

The Canadian Climate Institute recently published an assessment of projected emission reductions between 2025-2030, and determined that the consumer price (disaggregated from industrial pricing) is the 4th most impactful policy, responsible for around 10% of the projected emission reductions from policies currently in place.

The CCI further notes that “as designed, the fuel charge would have a larger impact over time as emitters invest in new technology and assets.”

Carbon rebates are fair.

The purpose of the price is to change behaviour, not to generate revenue.

At least 90% of the revenue is rebated directly to individuals who file their taxes. And there’s a top-up for rural Canadians.

The rebate makes 8 out of 10 of households better off on a cash transfer basis (taxes paid, rebate received), as determined by the Parliamentary Budget Officer.

Only the top 20% pays more than they receive back. Why? Because they pollute more.

According to StatsCan modelling, 94% of households earning $50,000 or less will receive more in the rebate than they pay in the price.

Now, there’s a legitimate debate to be had about the economic costs of different climate action. I’ll get to that in a moment and how the PBO has dealt with it.

There’s also a legitimate complaint to be made that the other 10% of revenue has not yet been distributed to businesses and other institutions, as promised. For simplicity in communication, I prefer that all of the revenue is returned through the rebate, whereas a Conservative colleague suggested to me recently that he’d be more supportive if the revenue paid for adaptation efforts. I’m fine with all of the above.

What I’m not fine with is the repeated lie that the price on pollution is responsible for people lining up at food banks.

Pierre Poilievre isn’t going to help poor people.

It is deeply cynical and wrong to trade on the real stress and struggle of so many to kill the most cost-effective way of reducing pollution.

And yet, Poilievre consistently tells us that food bank usage is at a record high and that axing the tax will “bring home affordable food.”

You’ve almost got to admire the liar. Because it is an incredible lie.

Yes, food bank usage is at a record high. Mostly Conservative Premiers, responsible for administering welfare and disability income supports, should be ashamed of the pitiful benefit levels for those in need.

No, food bank usage is not at a record high because of the price on pollution. The affordability crisis is driven by 20%+ inflation in food and shelter costs over the last couple of years, the latter driven partly by high interest rates.

As economists Tombe and Winter put it:

“With the latest data, we find that the gradually increasing indirect taxes, including carbon taxes, have caused overall consumer prices to be only 0.6% higher in October 2023 than they were in January 2015.”

These are effects, to be sure, but they are orders of magnitude smaller than the actual increases in prices we’ve seen in Canada.

Carbon pricing is definitively not to blame for affordability challenges.”

If Poilievre cared about poor people, he wouldn’t weaponize their real hurt to attack unrelated climate policies. Instead, he would champion expanding the Canada Workers Benefit and and delivering a substantive Canada Disability Benefit, among other poverty reduction measures.

Finally, it’s worth noting that low-income households (the bottom quintile) remain significantly better off after the rebate, even taking into account the PBO’s additional economic analysis. So no, the carbon price isn’t sending people to food banks.

And that’s assuming the PBO’s analysis is complete, which it isn’t.

What should we make of the PBO report?

Every party is quoting the PBO and it’s caused a frustrating amount of confusion.

To recap, the PBO tells us that most households are better off on a fiscal basis. In other words, most households receive more from the rebate than they pay in the price.

However, the PBO goes on to say that, accounting for both fiscal and economic costs, most households will be worse off due to the carbon price’s modest hit to GDP.

I met with parliamentary budget officer Yves Giroux and his team this afternoon with two concerns about their economic analysis (they were very generous with their time).

First, the economic literature seems mixed on this question. For example, in this macro analysis of carbon taxation in the EU, published in the American Economic Journal, the authors “find no evidence for a negative impact on employment or GDP growth but rather find a zero to modest positive impact.”

The PBO’s answer (paraphrased): the authors used a different model and we stand by ours. Fair enough.

Second, there is a major caveat, namely that the report “does not attempt to account for the economic and environmental costs of climate change.”

Nor does it account for the costs of alternative, more costly, climate action.

The PBO’s answer (paraphrased): we recognize the costs of climate change and attempted to assess those costs in a separate report. Climate action is like sending weapons to support Ukraine; it might be easy to quantify the upfront costs and hard to quantify the long-term benefits, but it’s still the right thing to do. While our mandate was to assess the cost of the specific proposal before us, we acknowledge that pricing pollution is the most cost effective measure to reduce emissions.

I respect the PBO a great deal and think they do excellent work as a general rule. Still, it remains hard to understand what insight the economic analysis adds to the debate, without a fuller accounting for the costs of inaction or alternative action.

After all, as Tombe and Winter reiterate: “Importantly, were it not for carbon pricing, Canada would have to adopt other, less-efficient policies that would have an even larger drag on growth and therefore larger costs to households – all without the current rebates.”

“Technology not taxes” isn’t a serious plan.

Incredibly, Poilievre calls the price on pollution a “scam” in the same breath that he offers the snake oil of “technology not taxes.”

Again, if there isn’t a price on pollution, alternatives measures will be more expensive.

We certainly aren’t going to see equivalent climate action from the private sector if businesses don’t have incentives to innovate. The bottom line trumps ESG every time.

So if you want technology, it will be left to more costly regulations or government subsidies. And where do government subsidies come from?

They come from taxes. Without the rebate.

Axing serious climate action.

Paul Romer, the other 2018 Nobel Prize winning economist, has rightly said that “the problem is not knowing what to do. The problem is getting consensus to act.”

And that’s what this is really about. It’s a relentless conservative campaign to undercut serious climate action, and destroy any consensus to act.

With the Liberals in government, we have finally seen serious climate action.

The Canadian Climate Institute estimates that the policies currently in place will prevent 226 Mt of emissions in 2030. Policies under development will prevent a further 43 Mt. Additional announced policies should account for another 39 Mt.

We can’t let up on serious implementation, and even then we still stand to fall about 30 Mt short of a target that should already be stronger.

So there is more to do. For example, considering the record profits of oil and gas companies in recent years, we could mandate that excess profits be invested back in efforts to reduce emissions, clean up environmental damage, and support sustainable jobs. UK Conservatives should not be more progressive on this front than we are.

We also haven’t been without missteps, including and especially the $35 billion pipeline expansion sinkhole.

But this is equally indisputable: in 8 years, this Liberal government has put policies in place to bend the emissions curve by 30% from where it would have been otherwise, with further policies on the way to bend it by another 10%.

So call it imperfect, but that is incredible progress all the same.

And so much of it will be undone if Poilievre and his new reform party have their way. Not only the market-based price on pollution, but the oil and gas emissions cap, the clean electricity regulations, and more.

We can’t afford to spike this progress or axe serious climate action.

Inaction is just too costly, both to our finances and our future.

And that is what is really at stake.

Excellent blog, Nate. Keeping in mind that we are not economists, I have a bigger issue with the Parliamentary Budget Officer's report than the absence of counterfactual climate cost calculations (which are admittedly difficult to measure given many abstract contextual factors).

Conservatives have been playing up the economic fallacy of *double-counting the same economic costs* in order to fabricate an imagined negative fiscal impact on the economy. Conservatives have been telling us that the carbon taxes are passed onto consumers (fair enough) but then also telling us that the carbon taxes create new costs for business (which is impossible to the extent that businesses are passing those costs onto consumers). I respectfully believe that the PBO is engaging in this same fallacy in his report when factoring in "Differential impacts on the returns to capital" to the "economic impact" of the tax. What is arguably missing from his report is that while businesses are (mostly) not formal recipients of the rebates, *the rebates offer an advantage for businesses* insofar as they supplement employees' livable incomes and thus depress employees' demand for higher wages. If the PBO is not considering the upside of the rebates to business income, then his report does not really give a proper aggregate value for all the gains and losses to most Canadians (never mind the unmeasured prevented climate costs).

Where I would find fault with the government however is in the inconsistent application of the tax. Setting aside the tax exemptions, imposing the policy as a "backstop" to provincial policies creates unnecessary disparate inter-provincial legal regimes for businesses in the way that a single nationwide tax would not. Also, I have to disagree with the idea of advancing the other climate programs alongside the tax. Really believing in the tax forces one to the logical conclusion that virtually all other GHG-reduction programs are *redundant* complications to the economy.

Right on. The tax on pollution is less than 2% of government's revenues - as seen in the pie chart here: https://www.canada.ca/en/department-finance/services/publications/annual-financial-report/2023/report.html#revenues. Scrapping it may be a good political make-believe win, but will certainly not turn life around for Canadians living in financial hardship, as the opposition claims. Total lie.